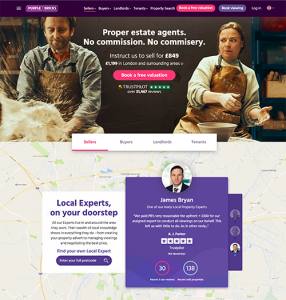

Lessons from Purple Bricks

First of all I’d like to say “congratulations” to Richard Tucker and all his team at Relocation Agent Network for an excellent conference/exhibition/awards last Friday – I thoroughly enjoyed being on the other side of the fence and observing all the hard work that goes into a major event.

First of all I’d like to say “congratulations” to Richard Tucker and all his team at Relocation Agent Network for an excellent conference/exhibition/awards last Friday – I thoroughly enjoyed being on the other side of the fence and observing all the hard work that goes into a major event.

The standard was set by the opening keynote speaker, Hamish Taylor, who I’ve not heard before. His career at Proctor & Gamble, Sainsbury’s, EuroStar and BA is as impressive a CV as you can get and the principle theme of his presentation is that you can learn everything you need from other industries. And whilst I agree with 90% of his observations and how lessons from his former companies can be applied by everyone, including estate agents, for me he got one thing very wrong when describing Purple Bricks as a “tech play”. It isn’t.

Purple Bricks doesn’t really have a tech advantage, or if they do then it can be copied very quickly, no, PB is simply a different business model and I offer the thought that it’s one traditional agents might want to have a good look at, particularly in the light of the changing legislation with tenant fees, etc.. In other words, yes, take Hamish Taylor’s advice and look to other industries for ideas but also have a good look at those closer to home too. So, here are some lessons from Purple Bricks.

I’ve stated several times how the PB fee structure results in not being a mile off the average charged by traditional agents.

On 17th October 2017, the Land Registry announced that the average UK house price is £225,956. As confirmed in our recent Home Moving Trends Survey, the average traditional agents’ fee is 1% which equals £2,710 incl.VAT per completed sale.

By contrast, PB charges:

- A fixed listing fee of either £849 or £1,199 depending on location.

- £300 for a viewing service that 40% of their clients take up.

- An admin fee if their clients don’t take up their preferred conveyancing partner (who, I’m told, pay PB £350 per case).

As PB don’t publish the number of their listings that complete, (to be fair I can’t find any traditional agents who publish both their listing and completed sales numbers), I now have to speculate a bit but Henry Pryor, (expert buying agent and the BBC’s favourite property commentator), tells me that roughly 50% of all listings fail to sell and complete after 12 months so I’ll use this for my formula:

£849 + (£300 x40%) = £969 x2 = £1,938 + (£350/2) = £2,113

£1,199 + (£300 x40%) = £1,319 x2 = £2,638 + (£350/2) = £2,813

On this basis, PB therefore charge an average of £2,463 per completion – just £247 less than the average traditional model (where the agent doesn’t receive conveyancing commission). This deficit is quickly made up when you factor in that the typical EA office costs c.£25,000 in rent and rates, (which equals £250 per completion for an office with 100 completions a year).

One of the biggest criticisms of the PB model is that those who don’t sell subsidise the costs of those who do. However, couldn’t the reverse be said of the traditional model? And aren’t the higher priced properties also subsidising the cheaper ones? I’ve yet to meet an agent who can demonstrate that the costs associated with selling a £400,000 property are double those of selling a £200,000 one, indeed aren’t they identical other than, with some agents, internal commission payments? So dare I say that as much as the PB charging model can be criticised so too the traditional model?

So, what are the advantages of PB’s fixed fee model that traditionalists might learn from?

- People don’t negotiate so much on a fixed fee, indeed I believe no one has ever “done a deal” on a PB fee.

- If a client and agent do negotiate on the fee, (actually make that, “if the agent discounts their fee”), then it will be for a smaller amount than is currently typical. Reducing a fixed fee by 10% is half that of going from 1.25% to 1%, which is a 20% discount.

- When the tenant fee ban comes into law then it makes even more sense to charge landlords a fixed fee per month for full management. As tenants typically seek to stay longer in a property then the set up fees become less important overall if there’s a higher monthly management payment.

- It’s so much more transparent – something all consumers say is really important to them.

- It’s fairer – every client pays the same, or as with PB charging more in London, there’s a justification for any increase.

In the last two years we’ve taken several of our members to Dubai to learn about fast growth from businesses there and to Silicon Valley to learn innovation from Facebook, Google, Tesla and AirBnB to name a few. In 2018 we’ll visit Tokyo to explore different cultures, systems and processes and how these can be applied to our sector but we will also examine different business models at home too, including those of the new types of estate agent. If you’d like to find out more about our trip to Tokyo and membership generally then call me on 01372 370815.

Purple Bricks are criticised a lot, but could it be that they’ve shown all of us that a new way of charging is what the consumer really wants and it can be good for the agent too?

If you have been sent this newsletter by a colleague and would like to register to receive the four-i Newsletters yourself, you can sign up here

Follow our social channels here: